As a result of the COVID-19 pandemic, around 70% of companies report a drop in turnover of 20% – 40%, 90% delays in business activities, and over 30% have started revising their management strategies and planning active investments, although only 3% of companies have been actively going ahead with DX promotion – Results of a questionnaire survey on COVID-19 among 290 companies and 411 individual respondents –

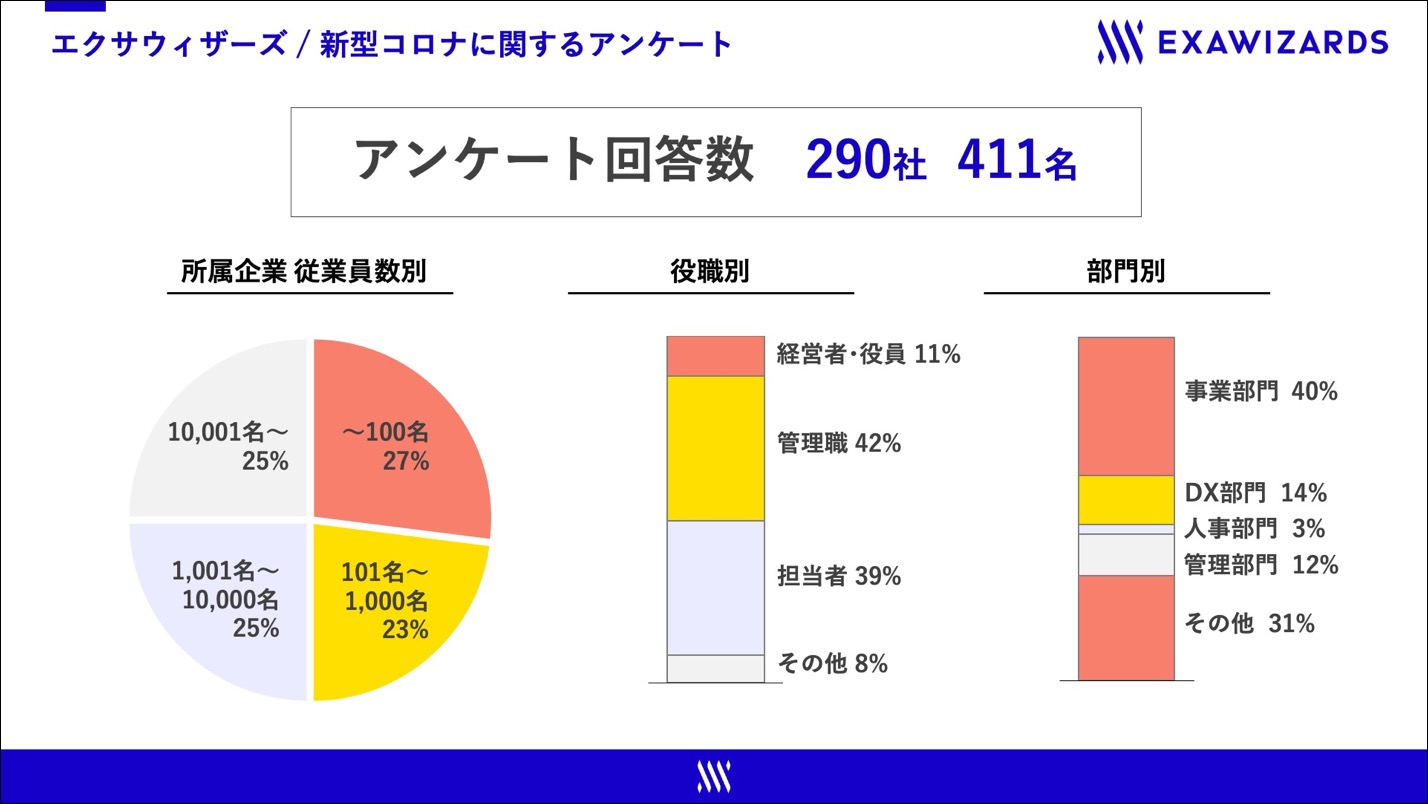

On May 8 (Thu.), ExaWizards Inc. (Headquarters: Minato-ku, Tokyo; Representative Director & President: Ko Ishiyama; hereinafter, “ExaWizards”) carried out a questionnaire survey among companies taking part in an online AI seminar on exaCommunity, a service administered by this company, eliciting answers from 290 companies and 411 individual respondents.

On April 22 (Wed.), ExaWizards carried out another questionnaire survey among companies on COVID-19. In this survey, many companies answered that they expect to continue feeling the effects of COVID-19 for a year or more, and it became apparent that while more companies are taking steps to enable remote working, only around 20% of companies have initiated fully-fledged DX promotion and AI utilization. (Source: https://exawizards.com/archives/9944)

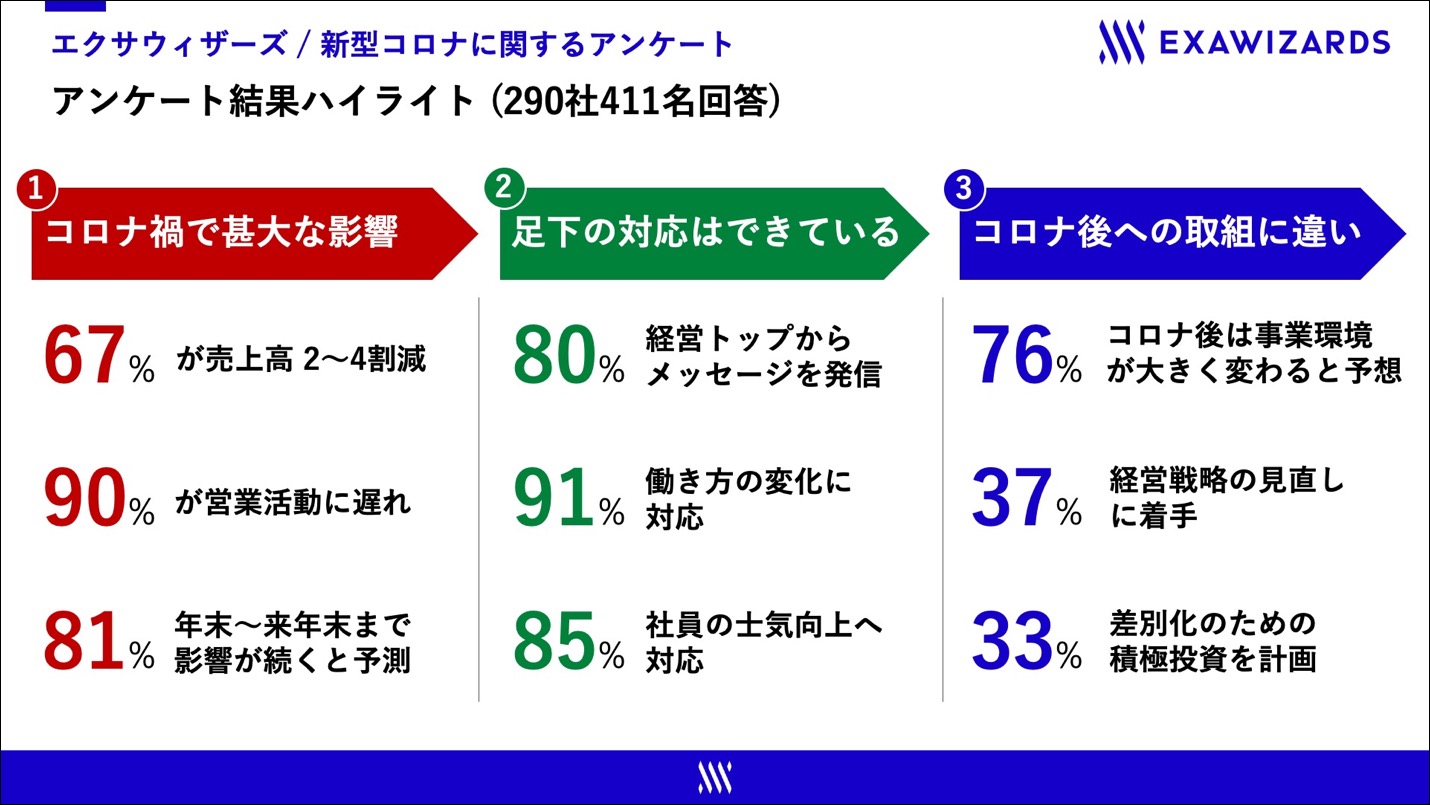

In this latest questionnaire, we widened the scope of the survey to include 290 companies, from SMEs to large companies. Centering on business and DX departments, we elicited answers from people in a wide range of positions, from department staff to managers. And as with the previous survey, it became clear that while all companies have been seriously affected by the COVID-19 pandemic, and that they have been taking immediate steps to deal with the situation, such as by introducing teleworking, a range of differences are beginning to emerge in terms of the measures by which each company is trying to reform its business operations, such as by making revisions to management strategies or coming up with investment plans.

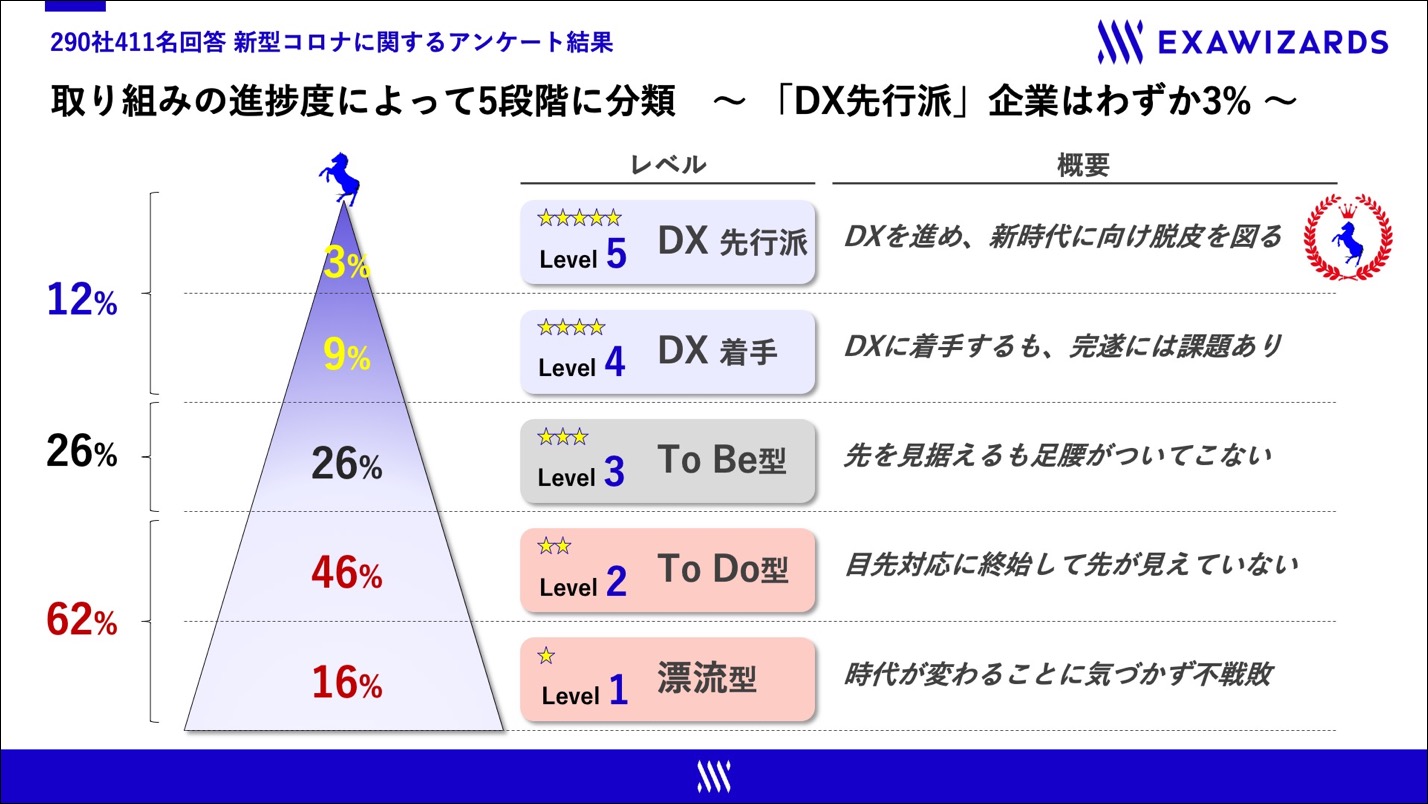

Having sorted the answers into 5 stages, we see that only 3% of companies have been actively going ahead with DX promotion

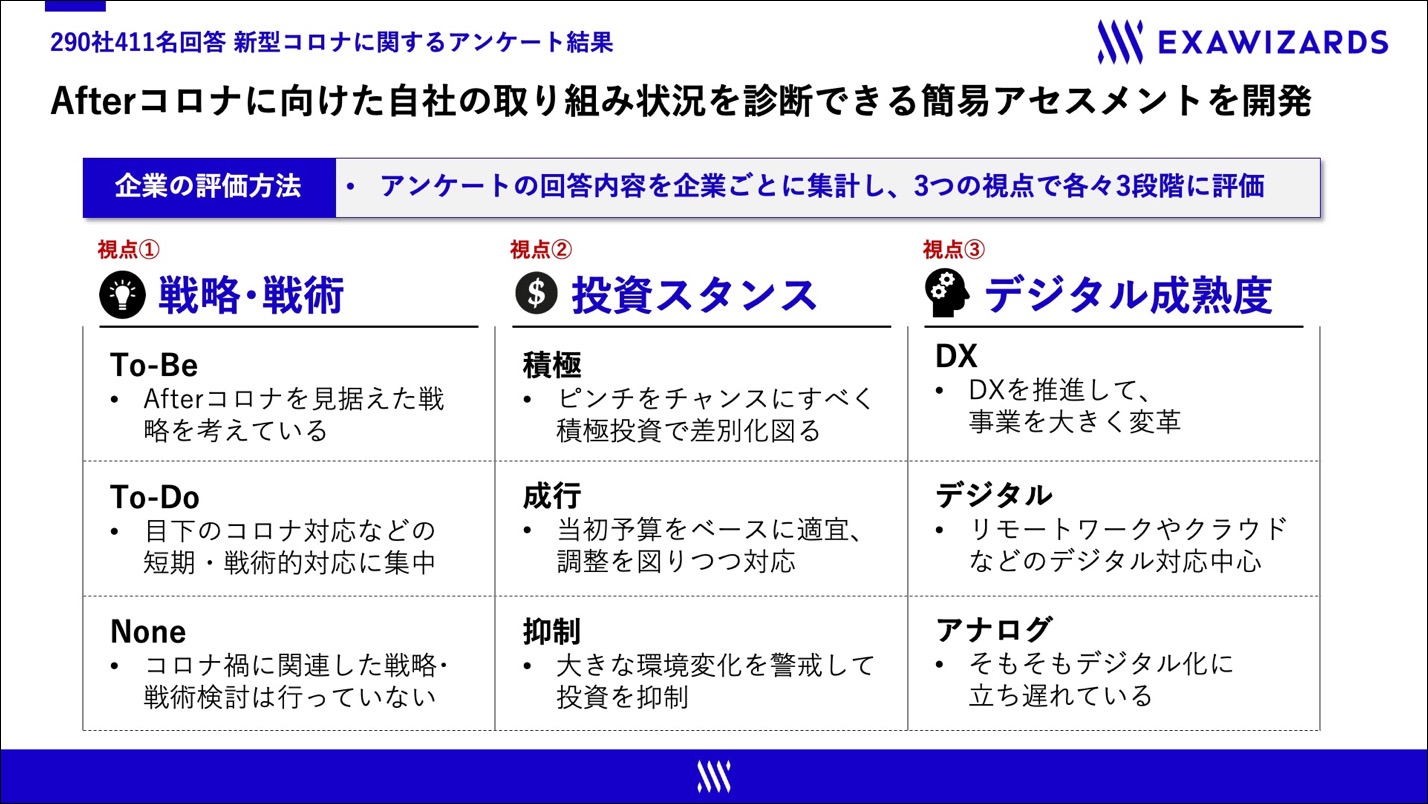

ExaWizards tallied the results of this questionnaire survey by company, and evaluated them into 3 stages from 3 perspectives: “Strategies/tactics,” “Investment stance,” and “Digital maturity.” By doing so, we developed a simple method of assessment that would enable us to examine the status of each company’s initiatives in preparation for the post-COVID-19 era. Having sorted the companies into 5 stages according to the degree of progress – “Actively going ahead with DX,” “Started going ahead with DX,” “To be type,” “To do type,” and “Drifting along type” – we see that only 3% of companies have been actively going ahead with DX promotion.

List of answers to the questionnaire survey on COVID-19

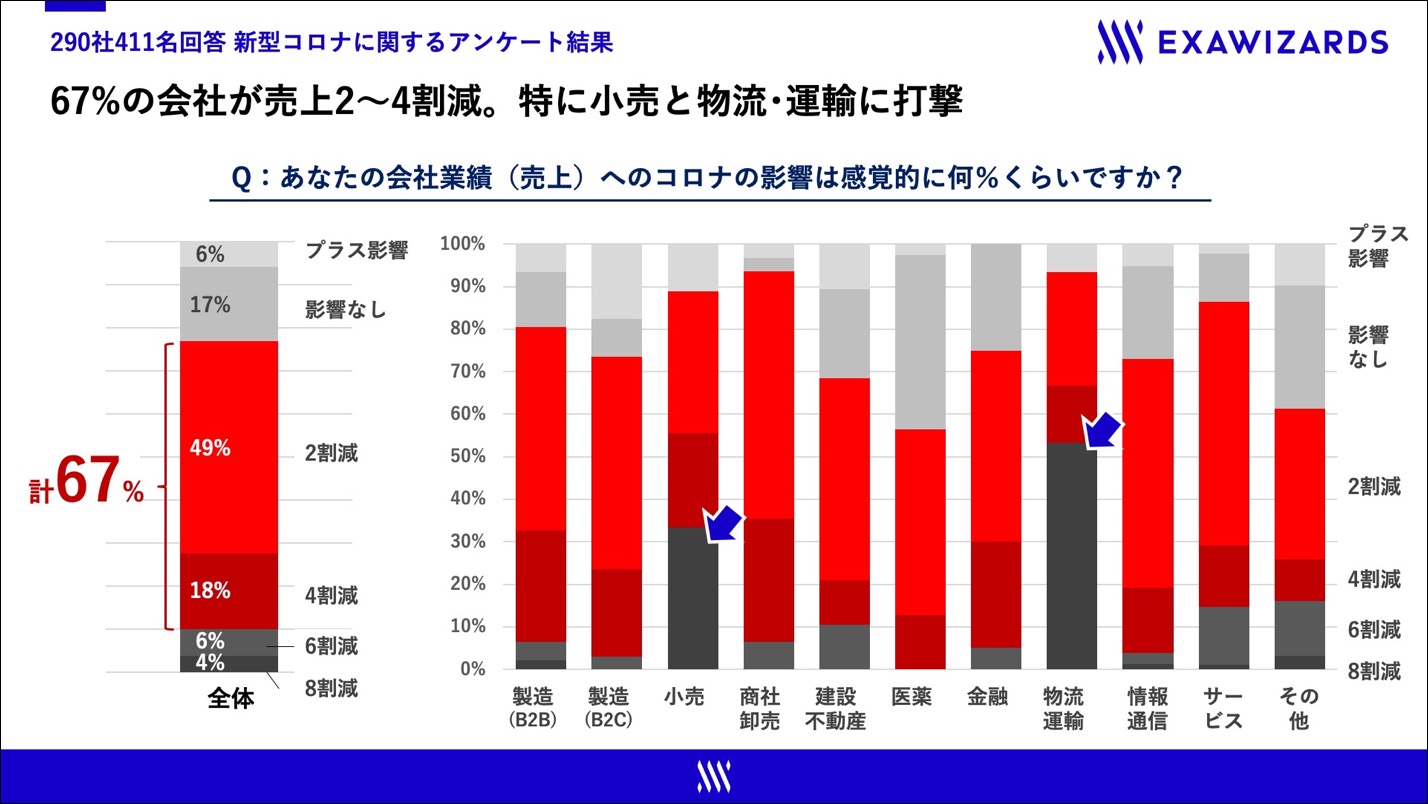

Q: In terms of percentage (%), around how much has the COVID-19 pandemic affected your company’s performance (turnover)?

The survey showed that the COVID-19 pandemic has had a serious impact on the performance of companies, irrespective of industry. Only 17% of companies answered “No impact,” with the majority (67%) answering that their turnover had either “Dropped by 20%” or “Dropped by 40%.” When looking at this by industry type, we see that retail and logistics/transportation have been hit particularly hard, with some answering that their turnover had “Dropped by 80%.”

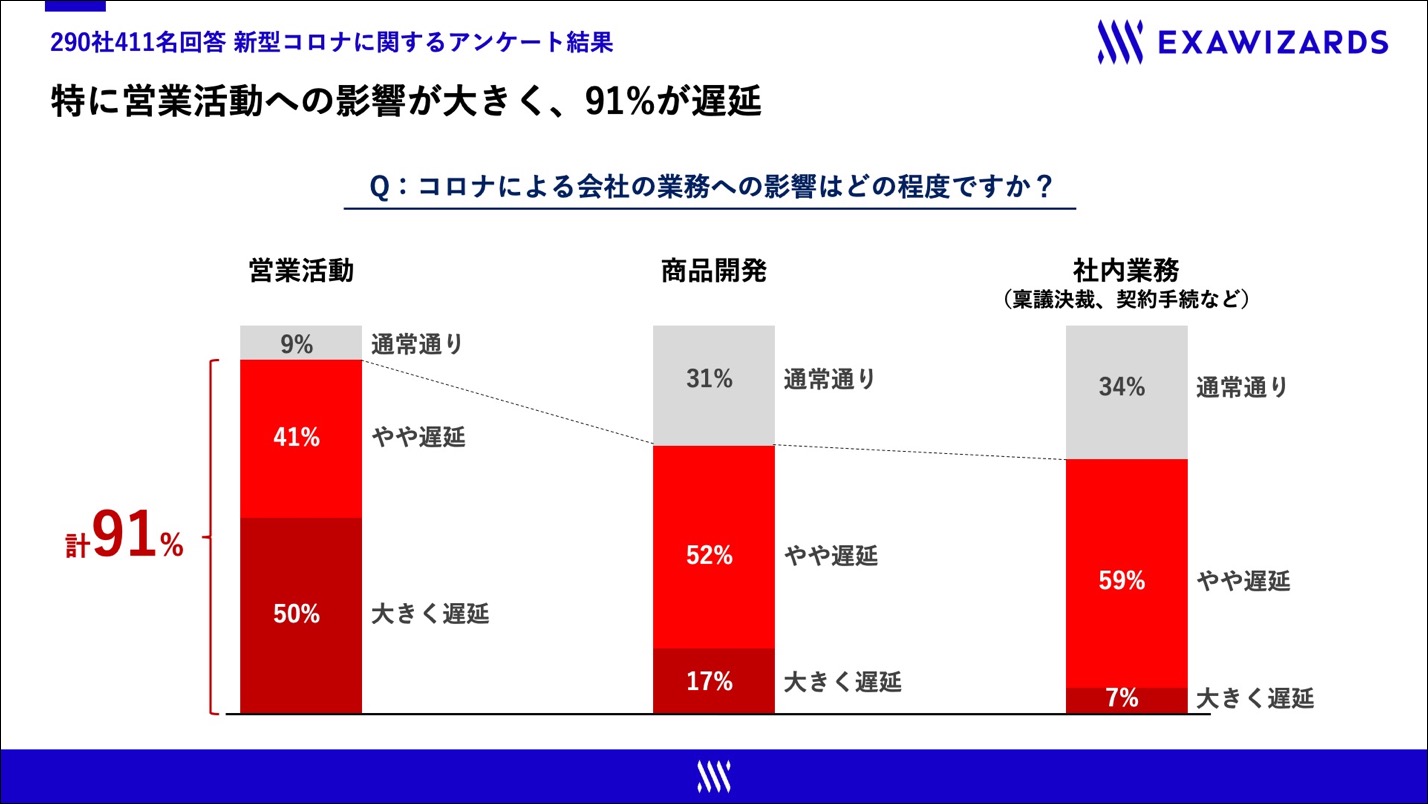

Q: To what degree has COVID-19 affected your company’s operations?

When asked about the impact of COVID-19 on their company’s operations, it became clear that there was a large impact on business activities in particular. Only 9% of companies answered that it was business as usual, with a total of 91% answering that their business activities had been delayed. Of these, 50% answered that their business activities had been significantly delayed. Meanwhile, although product development and internal operations had also been affected, the percentage was lower compared with business activities, and the extent of delays was not so large.

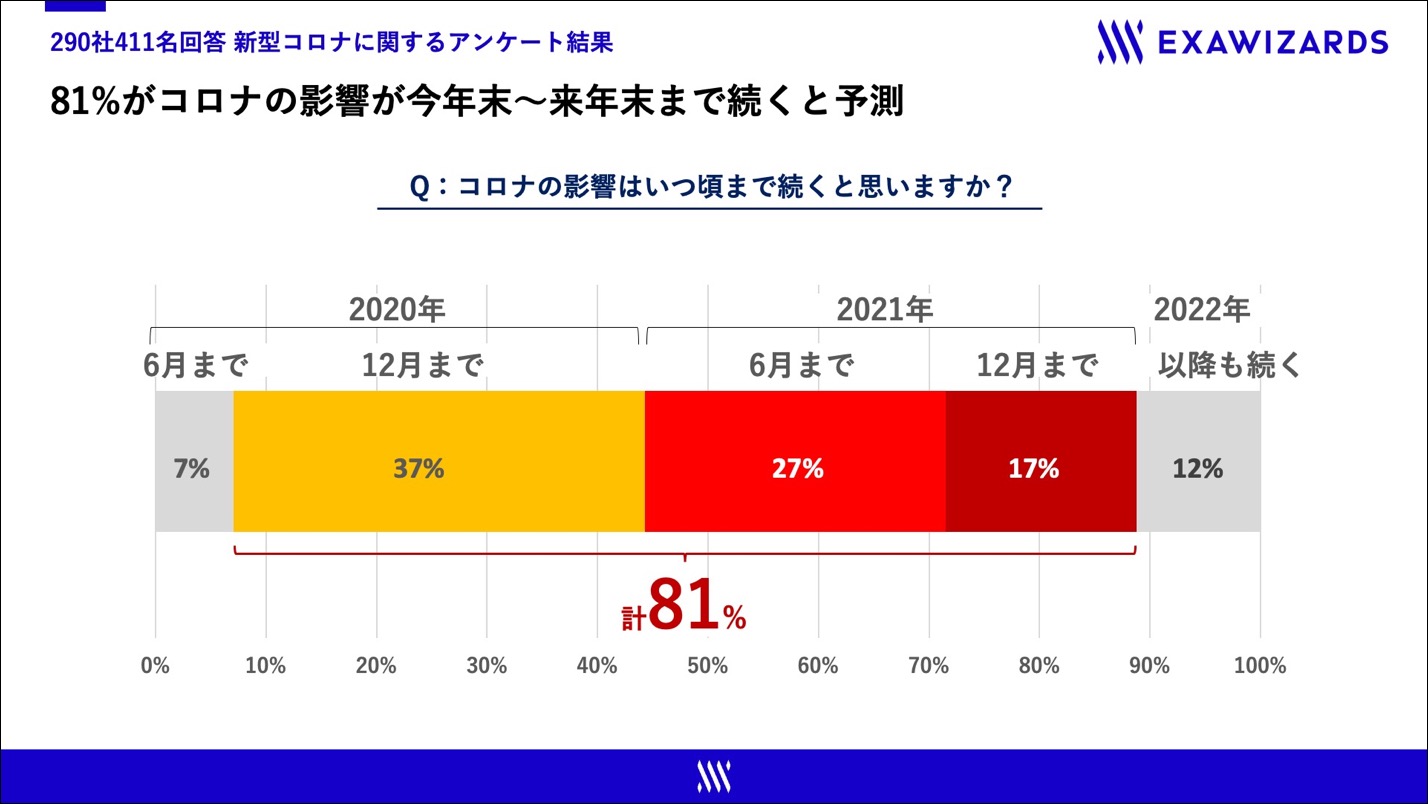

Q: Until when does your company expect to continue feeling the effects of COVID-19?

When asked until when they expect to continue feeling the effects of COVID-19, most companies answered “Until December this year” (37%), followed by “Until June next year” (27%), and “Until December next year” (17%). A total of 81% of respondents gave replies ranging from the end of this year to the end of next year, showing that they believe the effects will continue over the long term.

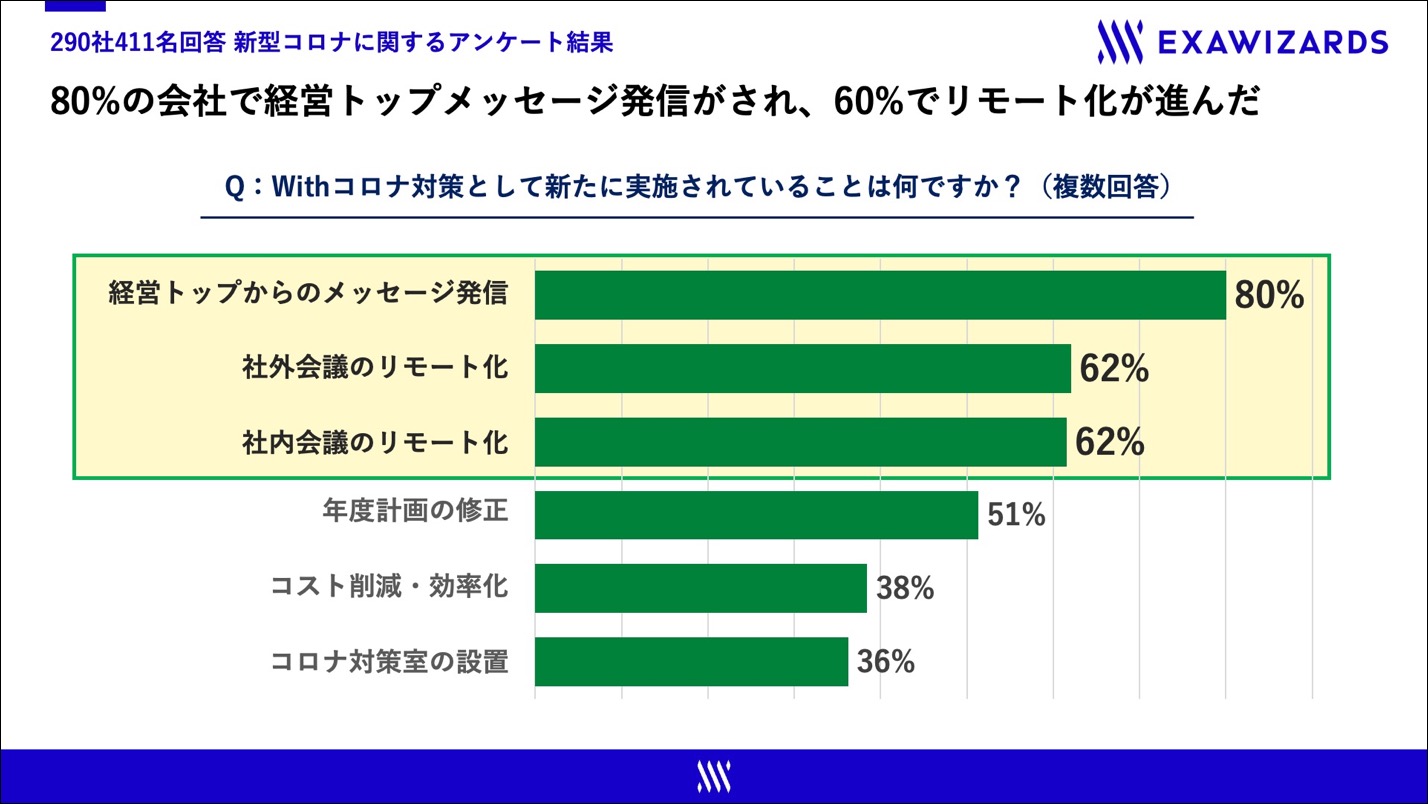

Q: Have you started anything new as measures for coping in the COVID-19 era?

In terms of new things companies had started as measures for coping in the COVID-19 era, 80% of respondents answered “Issued a message from top management.” Also, 62% answered “Enabled external and internal meetings to be held remotely.” The answers show how the COVID-19 pandemic has prompted many companies into introducing remote working for the first time, and that they have been taking whatever immediate measures they can to cope in the COVID-19 era.

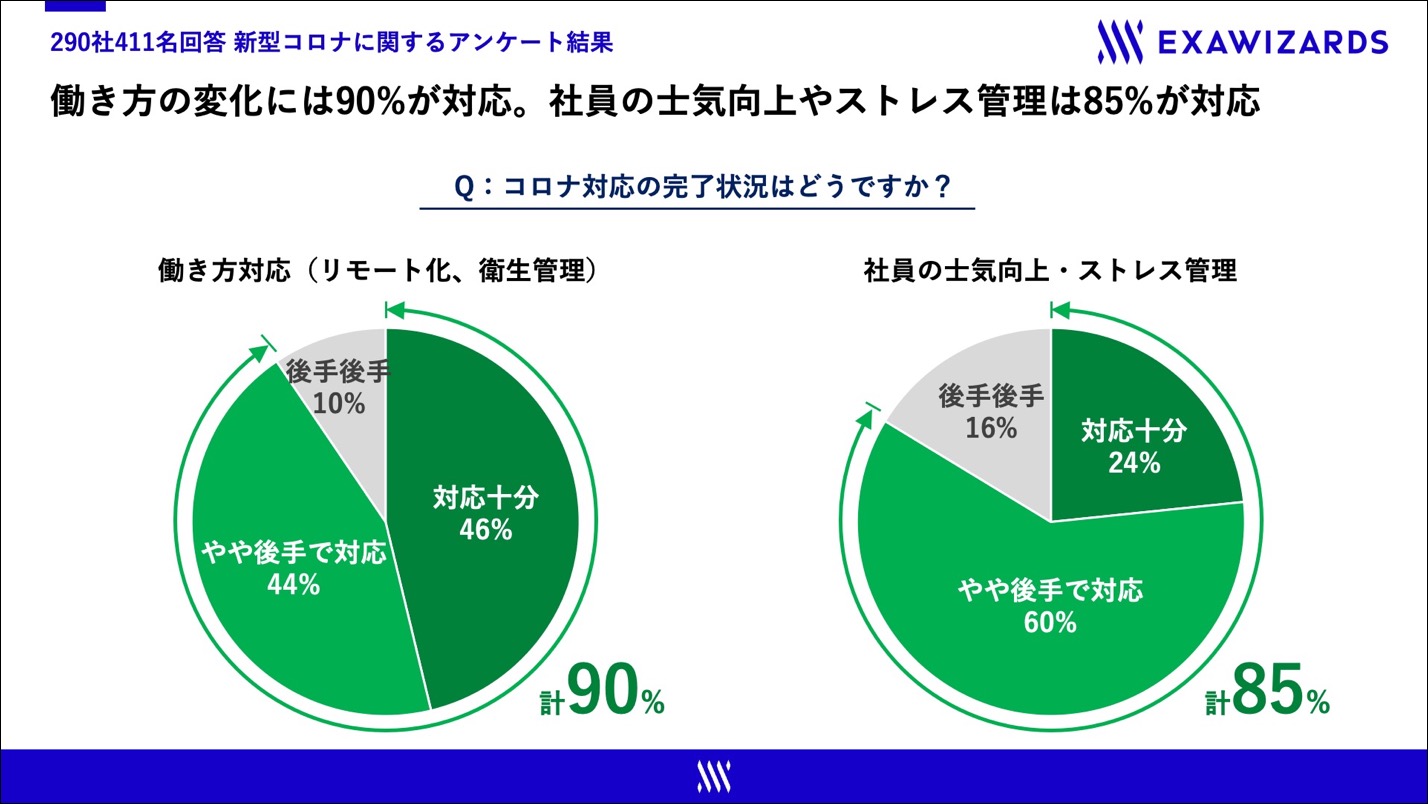

Q: How complete are your company’s COVID-19 measures?

Looking at the totals for those who answered that their company has taken sufficient measures or has taken measures albeit slightly late, 90% overall answered “Taken steps to reform work styles,” and 85% answered that they had “Improved motivation among employees/implemented stress management,” showing how companies are working to take whatever measures they can, even if late. Relatively speaking, the ratio of those answering that their company has taken measures albeit slightly late was higher for “Improved motivation among employees/implemented stress management.” This suggests companies began by putting in place measures to enable remote working in response to people being asked to stay at home during the state of emergency, and that they then went on to take steps to improve motivation among employees and implement stress management.

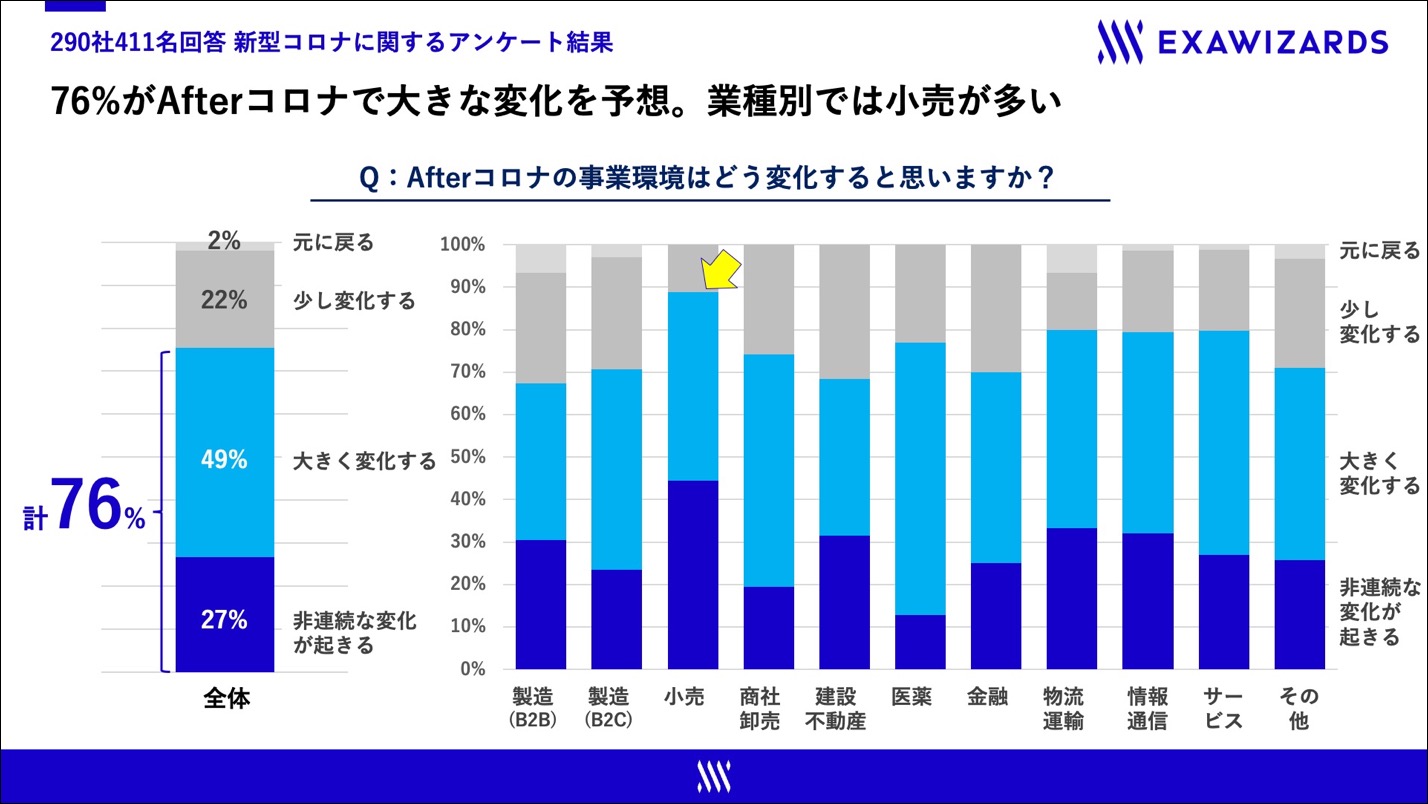

Q: How do you think the business environment will change in the post-COVID-19 era?

A total of 76% of companies answered that they think the business environment will change greatly or that change will occur on a discontinuous basis, suggesting that the majority of companies predict that the business environment will be quite different after COVID-19 than before. The ratio was high at 60% or more in all industry types, but the results suggest that awareness of this change is particularly high in retail, the industry in which many answered that their turnover had taken a serious hit.

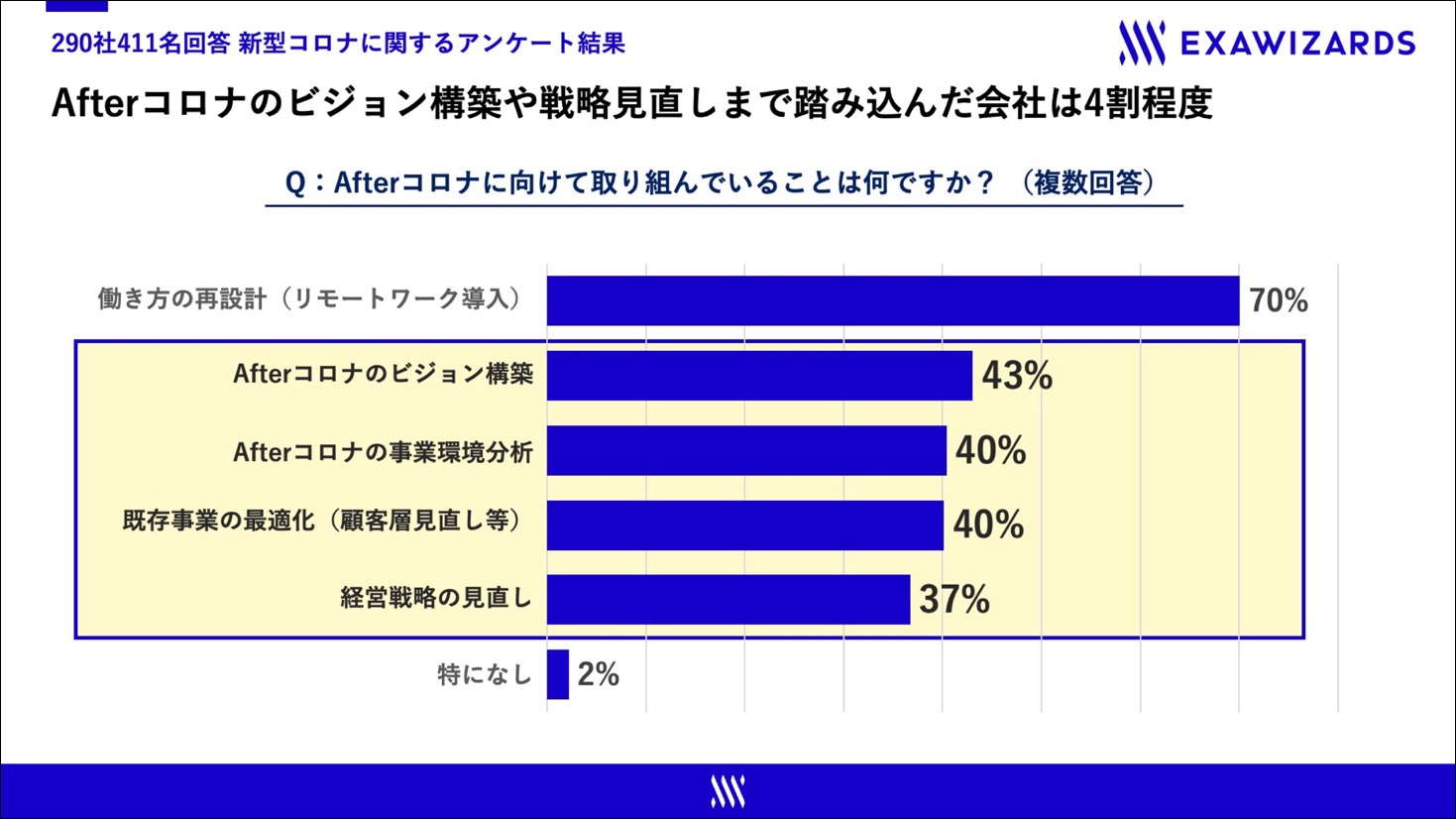

Q: What initiatives are you taking to prepare for the post-COVID-19 era?

With this recognition among companies that the business environment will change greatly in the post-COVID-19 era, while a high proportion of companies (70%) answered “Redesigning of work style (complete introduction of remote working),” only around 40% of companies had set to work constructing a vision or revising their strategies, such as “Construction of a vision/analysis for the environment for the post-COVID-19 era” and “Streamlining of existing operations/revision of management strategies.”

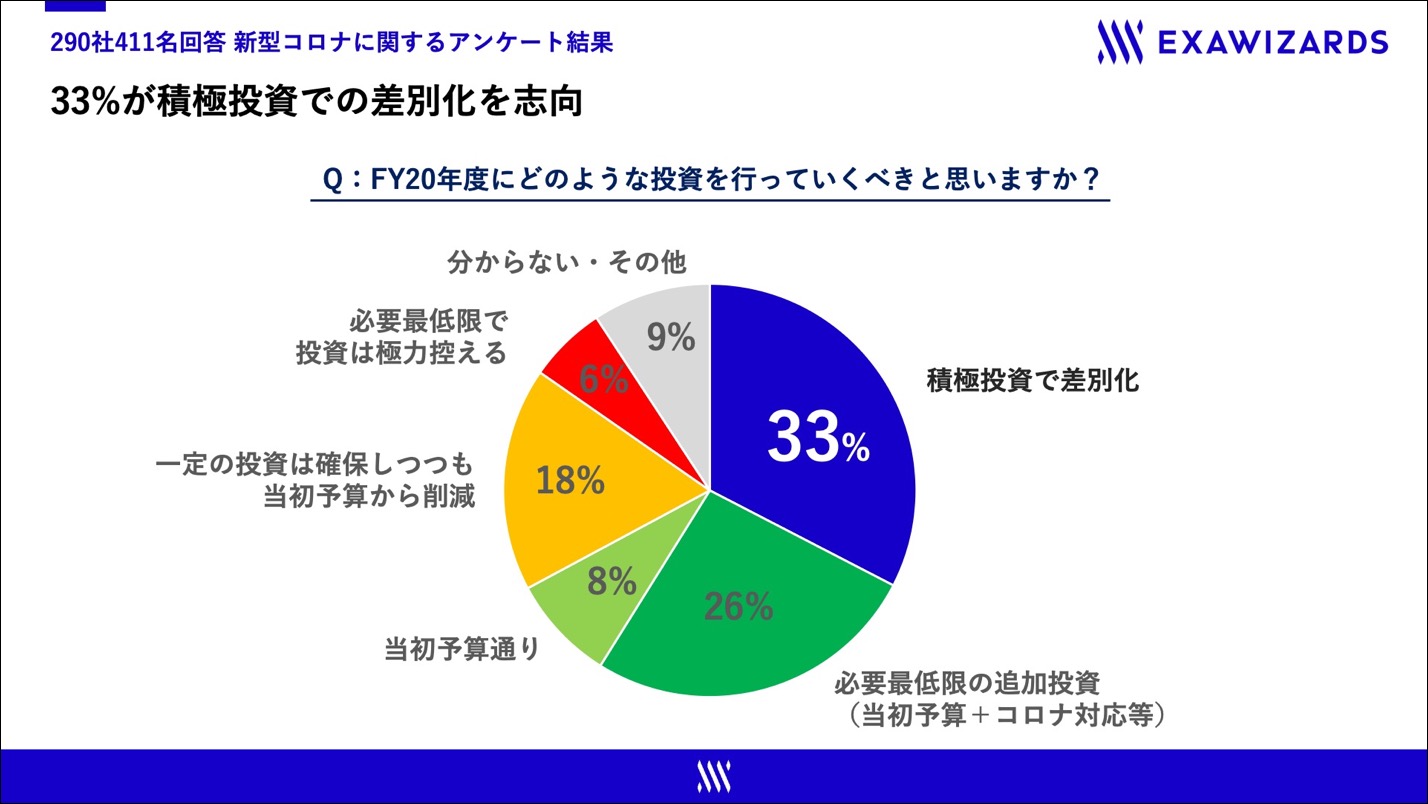

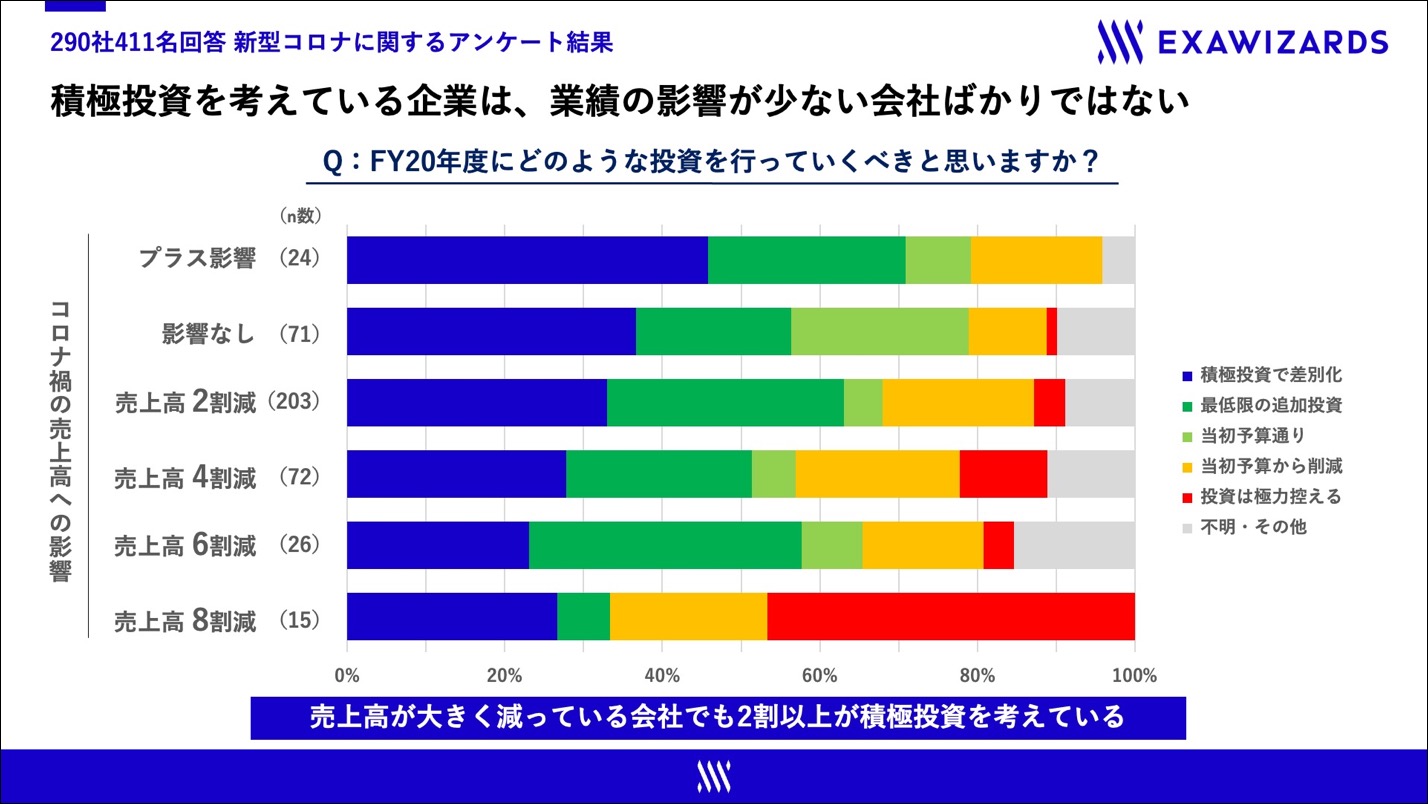

Q: What kinds of investments do you think your company should make in fiscal year 2020?

In terms of the investment stance of companies in the current fiscal year, a total of 24% answered that they would curb investments (“Keep investments to an absolute minimum” or “Maintain a certain level of investment while cutting from initial budget”), 34% that they would carry on with investments (“As set out in the initial budget” or “Make the minimum necessary amount of additional investments”), and 33% that they would make active investments. As such, the ratio of answers is split largely evenly.

In addition, cross analysis with the impacts of COVID-19 on turnover shows that the ratio of companies making active investments is higher among those companies whose turnover has been affected the least. However, even with companies whose turnover had taken a serious hit of 60% or 80%, 20% answered that they were considering making active investments, giving a sense how the investment stance of companies is split according to the company’s stance in anticipating the future rather than immediate business results.

Overview of questionnaire survey

Survey targets: 290 companies and 411 individual respondents who are currently implementing or considering DX promotion or the introduction of AI

Date of survey: May 8, 2020 (Thu.)

Overview of the exaCommunity service

exaCommunity, administered by ExaWizards, is a fee-based service for corporate members who use AI. By providing reports on case examples of using AI in business, video learning, articles, offline exchange meetings, events, etc., it helps corporations and their staff to solve issues and create new business by using AI.

Due to the recent spread of the novel coronavirus (COVID-19), we are now holding offline events online instead, and have put in place a fuller range of video content and articles through which people can learn about AI. We will continue to add to our online content to allow even those companies that have already introduced teleworking to actively learn more about AI.

In addition, we are also holding free online workshops for members on the introduction of AI and DX promotion to help them consider the kinds of challenges they will face in the post-COVID-19 era, and how to drive through reform. These workshops focus on the following three themes: “revising management strategy,” “reinforcing existing business operations through DX,” and “capitalizing on new business opportunities.” Based on these, we will help companies share their awareness of the issues through debates which bring the key members of companies together in a single virtual space, as well as through case study research and knowledge-sharing carried out by ExaWizards, which has been involved in over 200 projects a year helping companies introduce AI.

Content: Fee-based service for corporate members who use AI

Annual membership fee: 150,000 yen (excl. tax) *5 IDs are issued per registration (= 5 people can access at the same time)

Link: https://community.exawizards.com/

Applications for registration: https://community.exawizards.com/entry/

Example video content

The Future of Employment, by Dr. Michael A. Osborne: Online talk event via video streaming

“Surviving in the AI Age! Future Skills that Every Adult should learn”

Sample viewing: https://community.exawizards.com/member/yomoyama/sample_001/

Example online event

Online AI seminar by Ko Ishiyama, Representative Director & President of ExaWizards Inc.

“exaCommunity Special Seminar: Textbook for DX” (total 5 sessions)

Sample viewing: https://community.exawizards.com/member/yomoyama/sample_002/

[About ExaWizards Inc.]

Sticking to our mission: Solving social issues through Artificial Intelligence for future generations, we develop and commercialize AI products in a wide range of areas from caregiving, medical care, and human resource management to robotics and finance. Our members represent a kaleidoscopic variety of talent, including not only AI engineers but also software and hardware engineers, strategy consultants, UI/UX designers, as well as subject matter experts, researchers, and policy experts specializing in caregiving and other fields. Based in Japan, a super-aging society, ExaWizards, engages in product development with a thorough understanding of the front-line needs and issues in each field, while expanding globally through business development initiatives at overseas bases.

Website: https://exawizards.com/en/