Industries / Banking / Securities

The financial services industry is one of the first to be affected by the wave of digitalization. The shift of financial transactions to the Internet, the rapid penetration of cashless services, and the diversification of financing methods such as crowdfunding will lead to further changes in financial services. This will lead to the emergence of a "traditional financial services" vs. "emerging challenger companies," and the gradual expansion of the challenger companies will intensify the competition with Internet-based companies.

In recent years, the profitability of traditional financial institutions, which are labor-intensive, has been declining. While Europe and the U.S. have taken the lead in shifting to online finance and have seen an accelerated decline in various fees, traditional financial institutions in Japan have made only limited use of RPA, chatbots, etc. to improve operations and reduce costs.

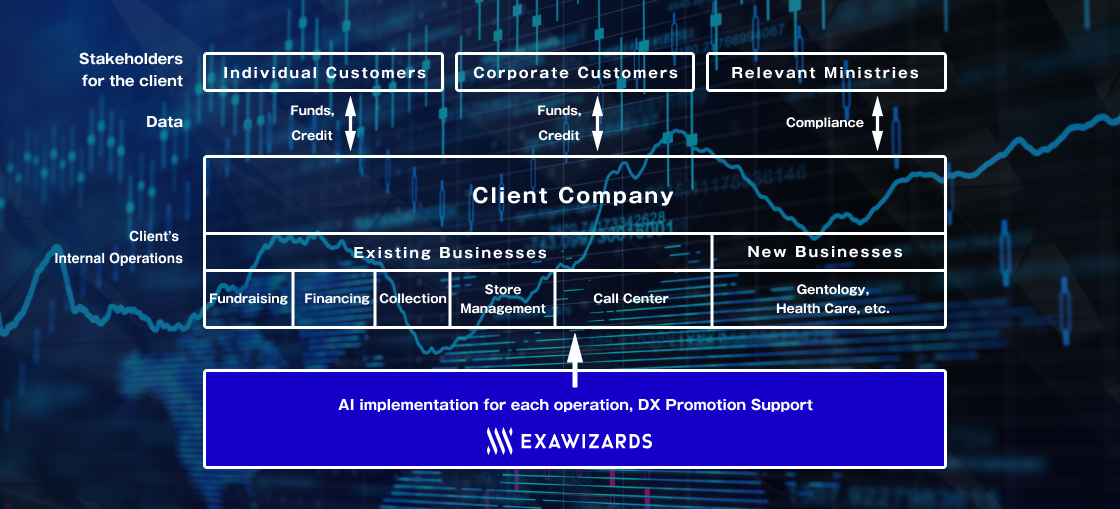

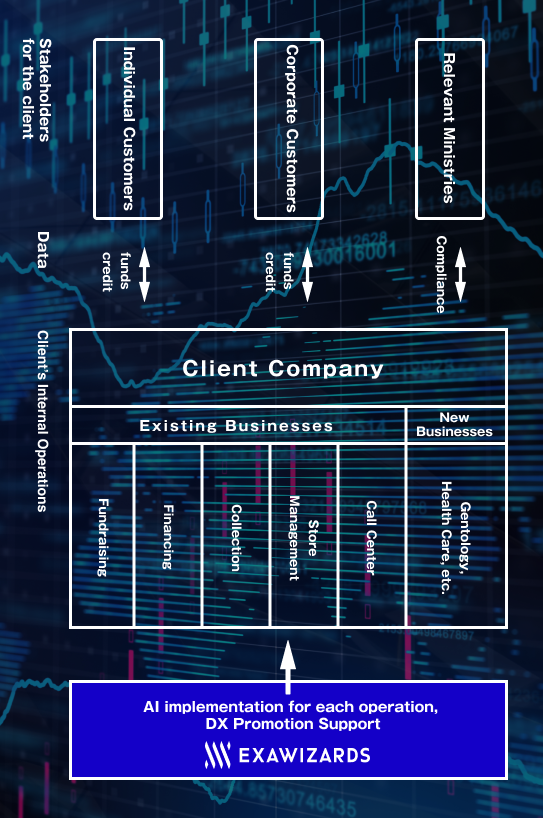

ExaWizards of point of view

At ExaWizards, we are working to implement new technologies in society by

(1) Improving productivity and reducing risks in existing businesses by strengthening security and compliance through AI implementation.

(2) Improve UX through personalization based on increased speed and granularity of personal data analysis through AI and digital implementation.

(3) Accelerate R&D and planning and implementation of new services in finance by combining knowledge from different domains such as healthcare and gerontology. With these three main perspectives in mind, we are working to solve social issues in the financial sector while also taking into account trends in government regulations.